Which of the Following Best Describes Supply Side Economics

According to supply-side economics the government needs to focus on policies to. B Tax rates particularly marginal tax rates affect the incentive to work save and invest and therefore aggregate supply.

Demand Side Vs Supply Side Economics Theories Differences Video Lesson Transcript Study Com

Which of the following best describes supply-side economics.

/supply_curve_final-465c4c4a89504d0faeaa85485b237109.png)

. Demand-side economics Keynesian economics Smith-based economics Supply-side economics. C eliminating the depreciation allowance. B Education affects labor productivity which affects aggregate supply.

C Education affects the incentive to work save and invest and therefore aggregate supply. An economic theory advocated by President Reagan holding that too much income goes to taxes so too little money is available for purchasing and the solution is to cut taxes and return purchasing power to consumers. Increases in social security taxes and other business taxes shift the aggregate supply curve to the right.

Asked Dec 24. A Labor productivity affects aggregate supply. Economic growth resulting from tax cuts will make up for revenue lost by tax cuts.

4 Which of the following best describes supply-side economics. Tax rates affect the incentive to work save and invest and therefore aggregate supply O B. 43 _____ A Education affects the incentive to work save and invest and therefore aggregate supply.

What is supply-side economics AP Gov. Education impacts labor productivity which impacts aggregate supply O C. 400 Select the pair that best represents the ideological positions of the two major parties.

C More questions like this Analyze the economics of aging including income assets and multiple jeopardy. Write a paragraph explaining the theory of supply-side economics. B Education affects labor productivity which affects aggregate supply.

Which of the following best describes supply-side economics. The correct answer is D. Which of the following best describes the economic effect that results from the government having a budget surplus.

-Reducing tax rates is the basis by which supply-side economics serves to increase income-generating activities and stimulate the broader economy. 1 Which of the following best describes supply-side economics. Economists who believe the supply-side effects of tax cuts are small essentially believe that A tax cuts mainly affect aggregate demand.

A reducing income taxes on saving. Economic growth resulting from tax cuts will make up for revenue lost by tax cuts. B reducing tax credits for research and development.

C Education affects the incentive to work save and invest and therefore aggregate supply. Up to 256 cash back A proponent of supply-side economics would advocate. Demand-side economics Keynesian economics Smith-based economics Supply-side economics.

The supply-side fiscal policy offers incentives to the producers Ask a question. Which of the following best describes the Keynesian approach to economic policy. Supply-side economics or trickle-down economics believes cutting taxes on the wealthy will positively impact the entire economy.

Asked Jul 5. A Labor productivity affects aggregate supply. B tax cuts mainly affect aggregate supply.

A European economic recovery could be facilitated by the adoption of strict laissez faire economic policies. 3 Which of the following would decrease the tax wedge. Also known as Reaganomics supply-side economics cut taxes on the wealthy in order to stimulate investment in the economy and boost employment.

Labor productivity impacts aggregate supply O D. Which of the following best describes supply side economics. Which of the following best describes supply-side economics.

Demand-side economics Keynesian economics Smith-based economics Supply-side economics Weegy. Transfer payments increase incentives to work. Economic policy of shielding an economy from imports.

Which of the following best describes supply-side economics. History 22062019 0630 jmonee. The correct answer is C.

2 The tax wedge is the difference between the A pre-tax and post-tax returns to an economic activity. Which of the following best describes the main argument of the author in the excerpted passage. What Reagan-era scandal involved the illegal sales of military weaponry in exchange for the release of hostages.

A Education impacts the incentive to work save and. Tax rates particularly marginal tax rates affect the incentive to work save and invest and therefore aggregate supply The tax wedge is the difference between the. Supply-side economics best fits the following statement.

1 Which of the following best describes supply-side economics. Supply-side economics best fits the following statement. Which of the following best describes the Keynesian approach to economic policy.

C tax cuts will increase the quantity of labor supplied. High marginal tax rates severely discourage work saving and investment. Economic growth resulting from tax cuts will make up for revenue lost by tax cuts.

Education impacts the incentive to work save and invest and therefore. Lower taxes on research and development of new technology. -It is widely held as the basis for the Tax Reform Act of 1986 championed by Ronald Reagan.

Which of the following statements best describes the study of economics. Which one of the following statements is correct under the theory of supply-side economics. Economic growth resulting from tax cuts will make up for revenue lost by tax cuts.

B The United States would be able to increase its international prestige by taking an active role in European affairs. Supply-side economics best fits the following statement. Supply side economics using deregulation and cutting taxes to boost the economy.

Economics questions and answers.

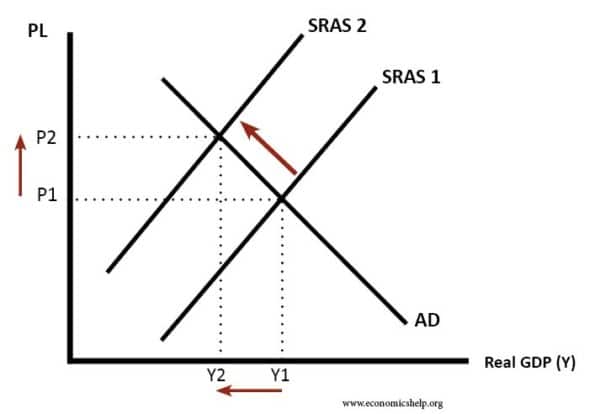

The Role Of Supply Side Policies In A Recession Economics Help

/Supplyrelationship-c0f71135bc884f4b8e5d063eed128b52.png)

No comments for "Which of the Following Best Describes Supply Side Economics"

Post a Comment